Financial Literacy and Crypto-Asset Ownership in Europe

Vilnius University

2026-01-20

Objectives

The role of financial literacy in shaping crypto-asset ownership remains empirically unresolved, with prior studies reporting conflicting results across countries and survey instruments.

This paper advances the literature by providing the first harmonized EU-wide evidence on how financial knowledge, digital confidence, and advisory trust relate to crypto ownership.

Research Question

- Crypto ownership in Europe is low, uneven, and not fully explained by standard accounts of financial literacy and distrust in financial institutions.

- Which are the predictors of crypto-ownership?

Predictors of Crypto-Ownership

Objective financial literacy

Evidence is mixed. Some studies find higher financial knowledge among crypto holders in developed markets, especially when crypto is treated as a risky investment rather than a payment tool. Others show that once risk comprehension is accounted for, financially literate individuals are less likely to adopt (Fujiki 2021; Stix 2021).

Predictors of Crypto-Ownership

Subjective literacy and overconfidence

Results are more consistent. High self-assessed knowledge and overconfidence are strongly associated with crypto ownership, even when objective literacy is low. Behavioural traits such as risk tolerance and gambling-style preferences matter (Carbó-Valverde, Cuadros-Solas, and Rodríguez-Fernández 2025; Kim, Hanna, and Lee 2023).

Predictors of Crypto-Ownership

Trust and exclusion narratives

Early claims that crypto adoption reflects distrust in banks or financial exclusion are increasingly challenged (Auer and Tercero-Lucas 2022). Most crypto users in advanced economies are banked, relatively high income, and digitally integrated.

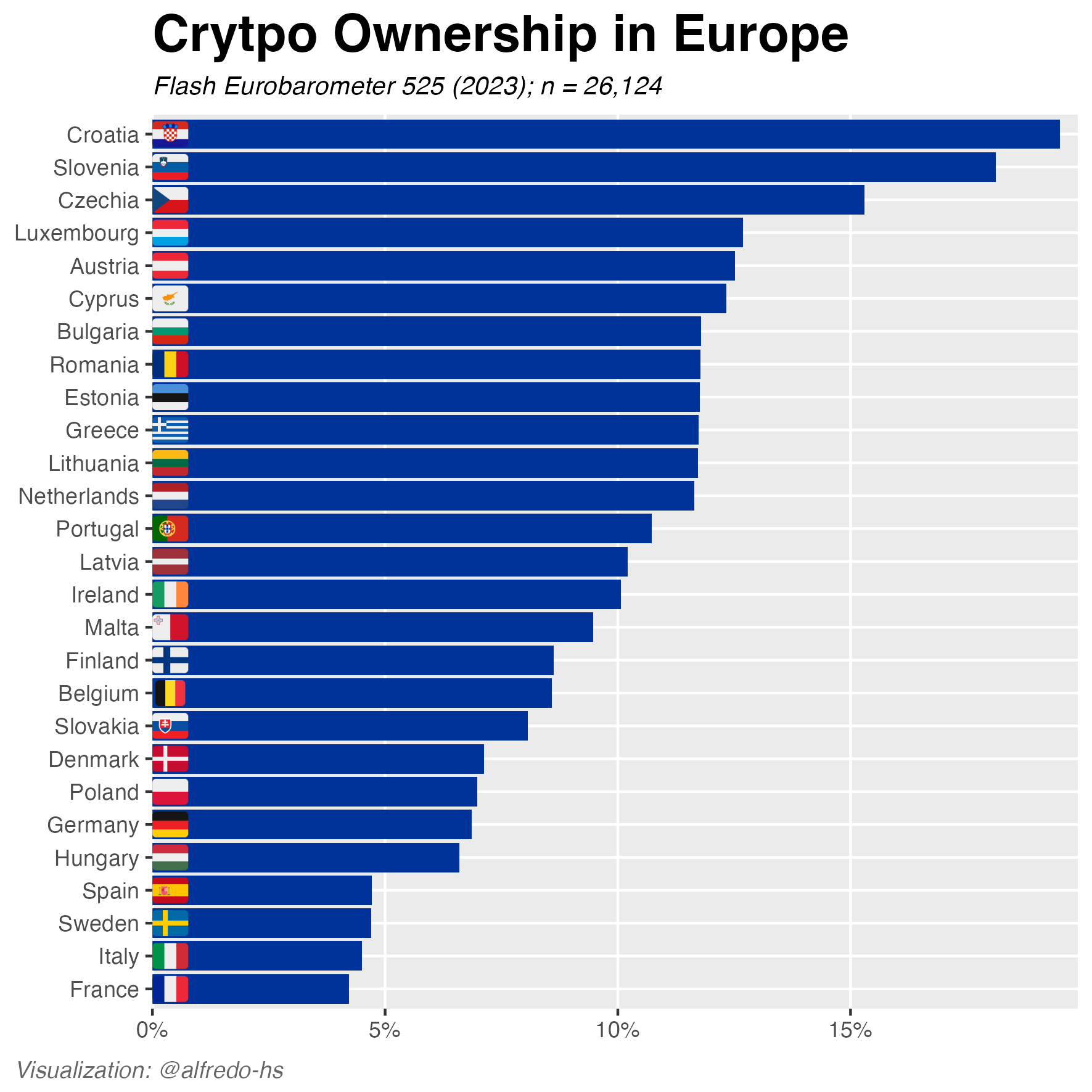

Data: Flash Eurobarometer 525

- EU-wide survey commissioned by the European Commission to monitor financial literacy

- Representative samples in all 27 EU Member States

- Total sample size: approximately 26,000 respondents

- Fieldwork conducted in mid-2023 using harmonised questionnaires

- Post-stratification weights adjust for age, gender, region, and education

Survey questions used in the analysis

Crypto ownership

Respondents report whether they currently have, or have had in the last two years, crypto-securities including cryptocurrencies.

Objective financial knowledge

Measured using a standardised financial literacy quiz covering interest compounding, inflation, risk–return trade-offs, diversification, and bond pricing.

Digital confidence

“How comfortable are you with using digital financial services, such as online banking or mobile payments?”

Survey questions used in the analysis

Advisor confidence

“How confident are you that investment advice you receive from your bank, insurer, or financial advisor is primarily in your best interest?”

Financial behaviour and prudence

Indicators capturing budgeting, monitoring expenses, and long-term financial planning.

Standard socio-demographic controls

Age, gender, income decile, and employment status.

Financial Knowledge Quiz (Example)

Q4 If interest rates rise, what will typically happen to bond prices? (EU average response)

- They will rise (29%)

- They will fall (20%)

- They will stay the same, as there is no relationship between bond prices and the interest rate (23%)

- Don’t know (28%)

Descriptives

| Variable | No N | No Distribution | No SD | Yes N | Yes Distribution | Yes SD |

|---|---|---|---|---|---|---|

| Financial Knowledge (1-5) | 23512 | 2.6 | 1.3 | 2612 | 3.1 | 1.2 |

| Financial Prudence | ||||||

| … low | 2141 | 0.09 | 203 | 0.08 | ||

| … mid | 6122 | 0.26 | 453 | 0.17 | ||

| … high | 15249 | 0.65 | 1956 | 0.75 | ||

| Digital Confidence | ||||||

| … none | 1250 | 0.05 | 45 | 0.02 | ||

| … low | 2553 | 0.11 | 124 | 0.05 | ||

| … mid | 9175 | 0.4 | 797 | 0.31 | ||

| … high | 10195 | 0.44 | 1637 | 0.63 | ||

| Advisor Confidence | ||||||

| … none | 3373 | 0.17 | 367 | 0.15 | ||

| … low | 7389 | 0.37 | 868 | 0.36 | ||

| … mid | 7772 | 0.39 | 960 | 0.4 | ||

| … high | 1369 | 0.07 | 218 | 0.09 | ||

| Gender | ||||||

| … female | 12659 | 0.54 | 699 | 0.27 | ||

| … male | 10788 | 0.46 | 1903 | 0.73 | ||

| … other | 65 | 0 | 10 | 0 | ||

| Age | 23512 | 49 | 17 | 2612 | 38 | 13 |

| Occupation | ||||||

| … employee | 11018 | 0.49 | 1612 | 0.63 | ||

| … self_employed | 2419 | 0.11 | 465 | 0.18 | ||

| … manual_worker | 1435 | 0.06 | 167 | 0.06 | ||

| … no_activity | 7795 | 0.34 | 335 | 0.13 | ||

| N. Observations | 20855 | 1 | 1.6 | 2167 | 0.66 | 1.1 |

Hypotheses

- H1: Objective financial literacy affects the likelihood of owning crypto assets.

- H2: Financial literacy overconfidence bias affects the likelihood of owning crypto assets.

- H3: Trust in financial advisors affects the likelihood of owning crypto assets.

- H4: Financial prudence increases the likelihood of crypto-asset ownership only when individuals possess sufficient digital knowledge.

Logit Model(s)

Equation 1 corresponds to the main logit model.

\[ ln(\frac{p}{1-p}) = β_{0} + β_{1}financial.knowledge_{i} + β_{2}financial.prudence_{i} + β_{3}digital.confidence_{i} + β_{4}advisor.confidence_{i} + β_{5}gender_{i} + β_{6}age_{i} + β_{7}occupation_{i} + β_{8}income.decile_{i} + β_{9}isocntry_{i} + \epsilon_{i} \qquad(1)\]

Equation 2 corresponds to the interaction logit model.

\[ ln(\frac{p}{1-p}) = β_{0} + β_{1}financial.knowledge_{i} + β_{2}financial.prudence_{i} * β_{3}digital.confidence_{i} + β_{4}advisor.confidence_{i} + β_{5}gender_{i} + β_{6}age_{i} + β_{7}occupation_{i} + β_{8}income.decile_{i} + β_{9}isocntry_{i} + \epsilon_{i} \qquad(2)\]

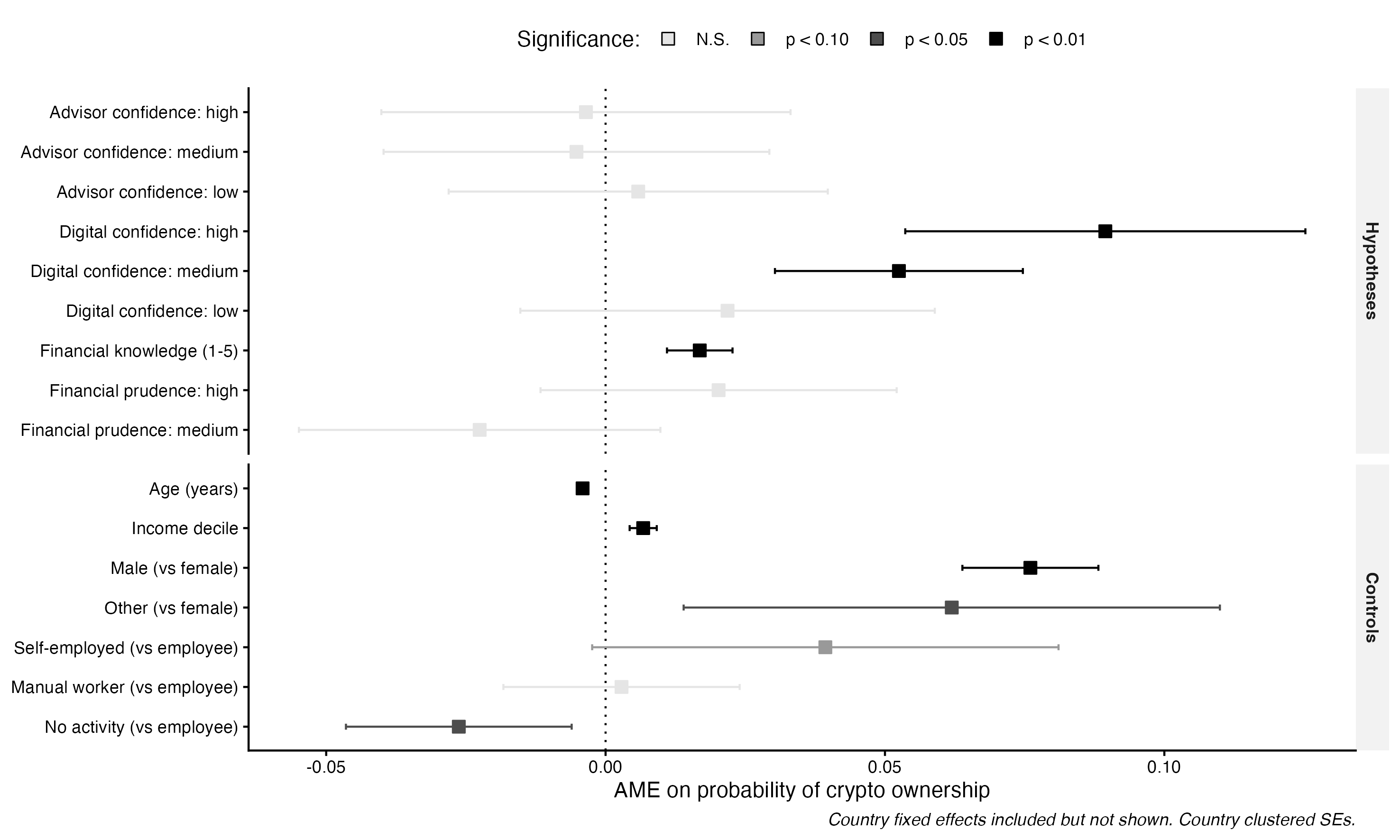

Logit Results

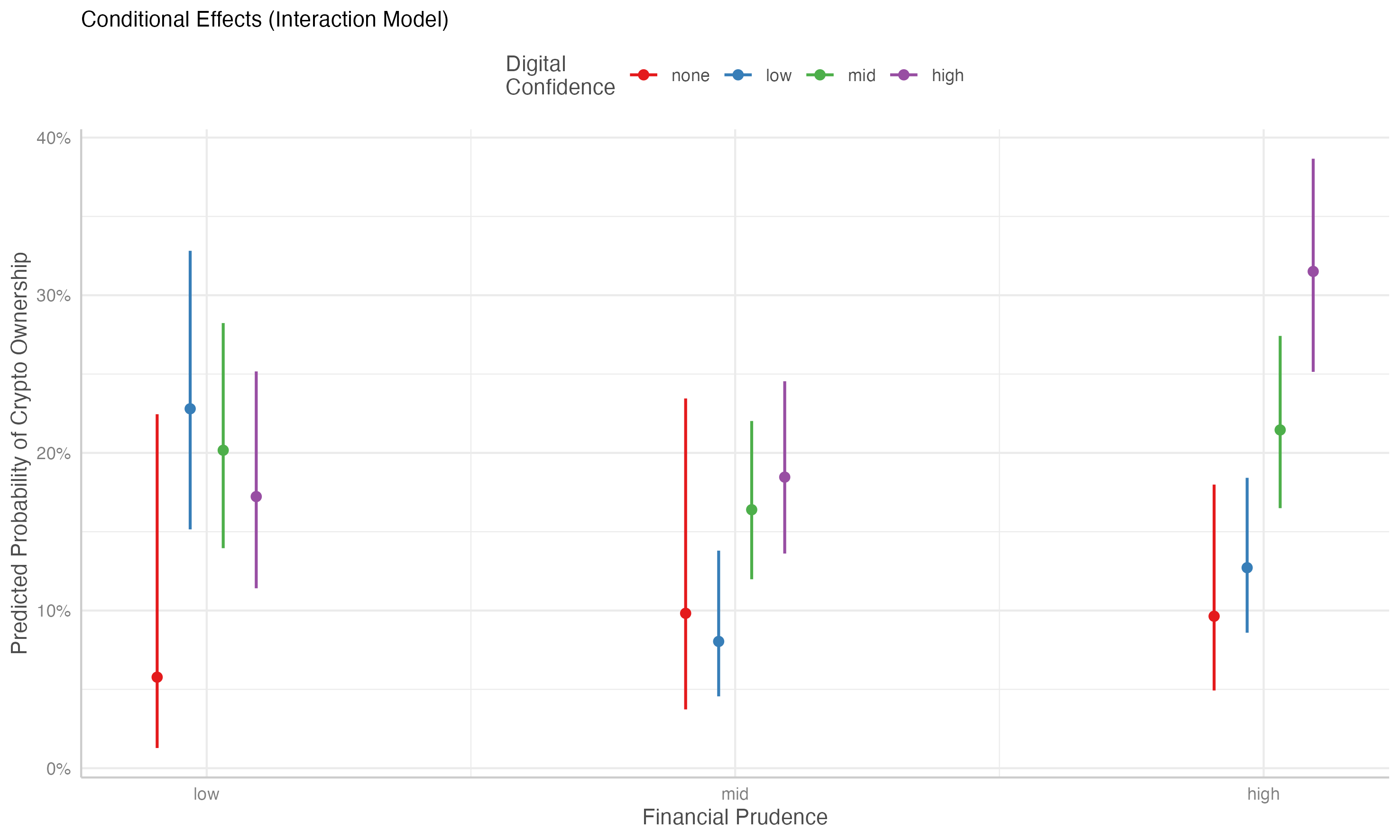

Conditional Effects (Interaction)

Findings

Objective financial knowledge is positively associated with crypto ownership.

Digital confidence is a much stronger driver than knowledge.

Younger, wealthier, employed males are significantly more likely to own crypto-currencies.

The distrust narrative is not supported in this specification.

At high digital confidence, higher financial prudence is associated with much higher predicted ownership.

Discussion

Crypto-ownership patterns suggest that the uptake of a digital euro will be shaped at least as much by digital confidence as by financial knowledge.

A digital euro may substitute for stablecoins or private payment tokens, but it may not eliminate demand for speculative crypto assets.

Advanced fintech products will disproportionately attract already advantaged users, while less digitally confident groups may be left with fewer options or higher exposure to harm through scams and misinformation.

Thank you for your attention!

This project has received funding from the European Union Marie Skłodowska-Curie Postdoctoral Fellowships / ERA Fellowships action under grant agreement No. 101180601 under the title: Understanding FinTech Regulatory Sandbox Development in Europe (FIRSA).

Learn more at the project website.

Appendix

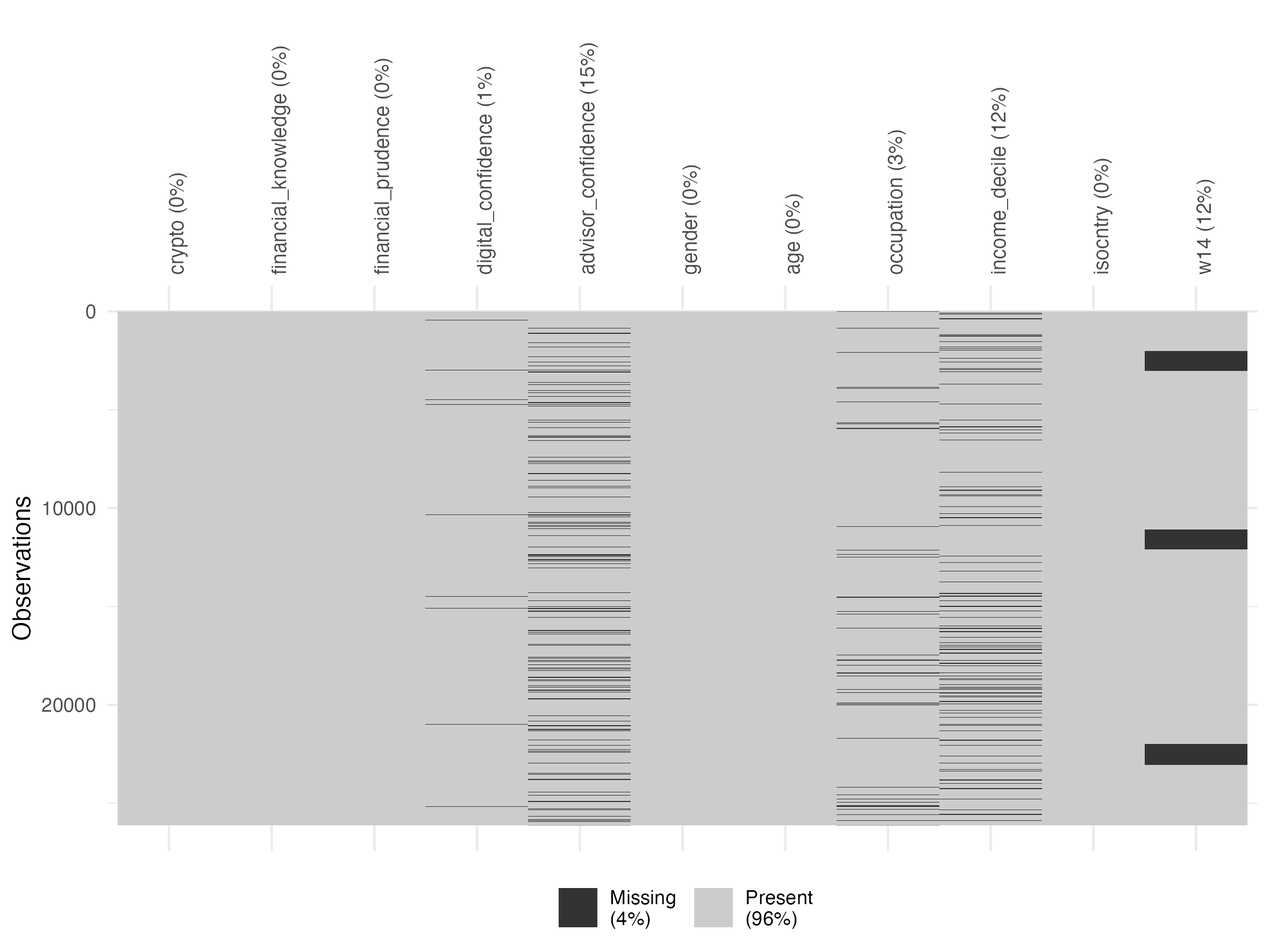

Missigness

References